Many service providers face the challenge of deciding, “Is this time billable?” and it’s a decision that really matters.

When the line between billable and non-billable hours blurs, it can lead to lost revenue, over-delivering, and reduced profitability.

In fact, studies show that businesses can lose up to 25% of potential revenue due to poor time tracking practices and unclear distinctions between billable vs non-billable time.

This guide is here to help you fix that by using effective time tracking software and proven strategies to manage your hours accurately.

What You’ll Learn:

- What is the difference between billable and non-billable hours?

- How Many Working Hours Should Be Billable?

- What Is Billable Utilization Rate?

- Why Does Automated Tracking of Billable and Non-Billable Hours Matter?

- How to Calculate Billable Hours

- How to Improve Your Billable to Non-Billable Ratio

- Common Mistakes to Avoid While Tracking Billable Hours

- Desklog: The Best Tool to Track Billable & Non-Billable Hours

Let’s get into the blog!

What is the Difference Between Billable and Non-Billable Hours?

Billable hours are time spent on client work that can be invoiced, while non-billable hours are time spent on internal tasks that can’t be charged to the client.

Billable Hours

Definition : Time spent working on tasks that are directly related to a client project and can be invoiced.

Examples :

- Writing code for a client’s software.

- Drafting legal documents.

- Consulting or meetings related to the client’s project.

- Designing marketing materials for a client.

Tracked Because : This is how businesses (especially service-based ones like law firms, consultancies, or agencies) earn revenue.

Non-Billable Hours

Definition : Time spent on tasks that are necessary for running the business but can’t be directly charged to a client.

Examples :

- Internal meetings.

- Administrative work.

- Business development or marketing your services.

- Training or professional development.

- Writing proposals or onboarding new clients (unless agreed as billable).

Tracked Because : It helps assess productivity, optimize internal processes and understand profitability.

Key Differences: Billable vs Non-Billable

| Aspect | Billable Hours | Non-Billable Hours |

|---|---|---|

| Definition | Client work that is invoiced | Internal or admin work not invoiced |

| Impact | Directly affects revenue | Indirect impact; supports efficiency |

| Example | Designing a logo for a client | Attending an internal team meeting |

How Many Working Hours Should Be Billable?

A common benchmark is 30–32 billable hours in a standard 40-hour workweek. However, this depends on industry, role, and your business model. For example:

- Agencies and consultancies aim for 75–80% billable utilization.

- Freelancers may fluctuate based on client load and scope.

What Is a Billable Utilization Rate?

Your billable utilization rate measures how much of your work time is spent on billable tasks.

Formula: (Billable Hours ÷ Total Working Hours) × 100

A higher rate indicates better time monetization. A low rate may reveal inefficiencies or excessive time spent on non-billable tasks.

Why Does Automated Tracking of Billable and Non-Billable Hours Matter?

As work environments shift and client expectations grow, tracking both billable and non-billable hours automatically brings so many advantages:

Supports Remote and Hybrid Work

With teams spread across locations and time zones, manual tracking quickly becomes unreliable.

Automation ensures accurate, consistent time data no matter where or when your team works.

Enables Transparent Client Billing

Clients increasingly expect clear, itemized invoices. Automated tracking makes it easy to justify billable hours with data-backed records, building client trust and minimizing disputes.

Powers AI-Driven Project Management

Today’s AI tools rely on real-time data to deliver insights.

Automated hour tracking feeds these systems with the information they need to optimize timelines, resources, and workflows.

Improves Financial Accuracy and Productivity

By tracking both billable and non-billable time, automation helps you calculate utilization rates, spot inefficiencies, and gain a full picture of where time and money are being spent.

How to Track and Calculate Billable Hours

Tracking billable hours accurately is essential for ensuring fair compensation and maintaining client trust.

There are two main methods to do this, each with its own advantages and drawbacks:

1. Manual Logging

Pros:

- Simple and free (especially if using pen and paper)

- Helps develop awareness of how time is spent

Cons:

- Time-consuming and prone to human error

- Easy to forget tasks or log them incorrectly

- Requires discipline and consistent effort

2. Time Tracking Software

Pros:

- Automatic Timers: Start and stop automatically based on activity, eliminating the need for manual input and capturing every billable minute.

- Project & Client Categorization: Easily assign time entries to specific clients and projects, ensuring more accurate billing.

- Reports & Analytics: Generate detailed reports to analyze work patterns, optimize workflows, and identify areas for improvement.

- Invoicing Integration: Many tools integrate directly with invoicing software, allowing for smooth billing and faster payments.

- Project Billing Features: Set custom billing rates, manage project budgets, and create invoices based on logged hours.

Cons:

- Usually requires a subscription or license fee, which may be a consideration for freelancers or small teams with tight budgets.

How to Improve Your Billable to Non-Billable Ratio

Improving your ratio means spending more of your time on revenue-generating work. Here’s how to make it happen:

1. Track Time Consistently

Encourage your team to track time in real-time or daily. Delayed entries often lead to missing billable work.

2. Automate Repetitive Tasks

Use automation tools to handle admin work like scheduling, invoicing, or status updates, freeing up more time for billable work.

3. Increase Team Awareness

Educate employees on what counts as billable vs. non-billable and why it matters. Awareness leads to more mindful time use.

4. Use AI Insights

Modern time tracking and project management tools now use AI to identify patterns, inefficiencies and suggest time optimization strategies.

Common Mistakes to Avoid While Tracking Billable Hours

Tracking billable hours accurately is key to increasing profitability and ensuring trust with clients.

Unfortunately, common mistakes can lead to revenue loss and invoicing problems.

Here are the pitfalls to watch for and how to prevent them.

Not Defining What’s Billable

Without clear guidelines, important billable tasks like brief client calls or prep work can be missed.

Tip: Create a detailed billing policy and regularly train your team on what counts as billable.

Overlooking Administrative Time

Some admin tasks, such as client emails or scheduling, are billable but often go untracked.

Tip: Identify which admin activities are billable and encourage accurate logging.

Poor Time Categorization

Vague labels like “miscellaneous” make it hard to distinguish billable from non-billable hours, causing confusion and disputes.

Tip: Use specific categories like “client meeting,” “report writing,” or “internal meeting” for clarity.

Relying on Manual Entries

Manual tracking is prone to errors and forgotten entries, leading to underreported billable time.

Tip: Use automated time tracking tools to improve accuracy and save time.

Desklog: The Best Tool to Track Billable & Non-Billable Hours

What is Desklog?

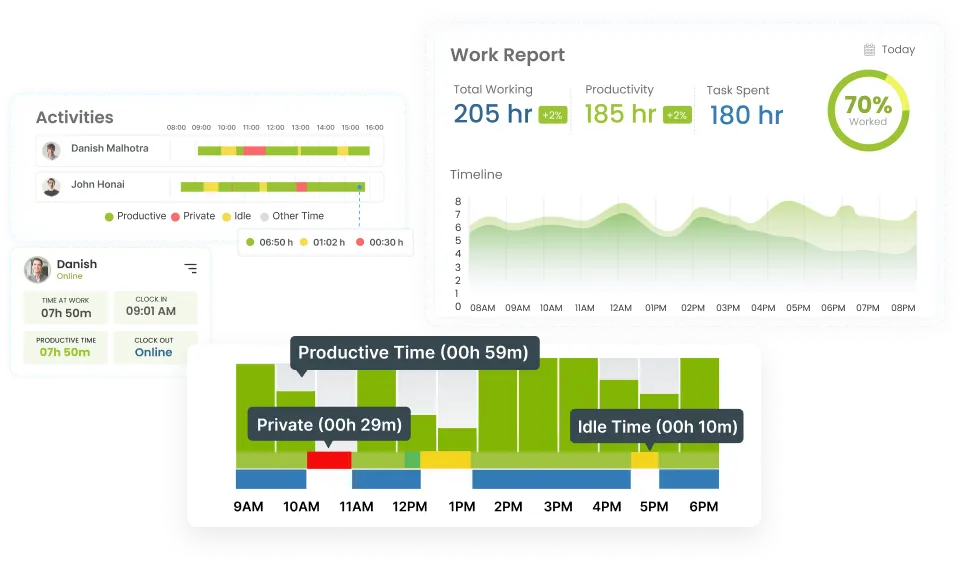

Desklog is a time tracking software and project tracking tool built for teams, agencies, freelancers and firms of all sizes that want to improve productivity, manage projects and accurately bill clients.

Desklog Features that Support Accurate Billable vs Non-Billable Hour Tracking:

- Automatic Time Tracking: Desklog’s automated time tracking feature eliminates the need for manual input and ensures every billable minute is captured accurately.

- Project Time Tracking: By tracking time spent on specific projects and tasks, Desklog allows you to easily allocate hours to billable client work versus non-billable internal projects.

- Billable vs. Non-Billable Tagging: Clearly set each project as billable or non-billable right from the start, helping you maintain accurate financial tracking and reporting.

- Reporting & Analytics: Generate detailed reports breaking down hours by project, client, and task , allowing you to evaluate productivity and project profitability at a minute level.

- Internal Billing & Invoicing Feature: You can track billable hours, configure billing types (flat, hourly by task, hourly by user) and generate invoices with Desklog’s billing and invoicing feature.

- Offline Time Tracking: Desklog tracks your time offline and syncs it automatically when you’re back online, ensuring no billable work goes unrecorded.

Why It Matters

If you’re tracking billable vs non‑billable hours, you need more than just a stopwatch. Desklog gives you:

- Better accuracy in logging time: Reduces revenue loss caused by missed billable minutes.

- Transparency for clients: Clear and categorized tracking leads to smoother, more trusted invoicing.

- A clearer picture of internal vs external work: Helps allocate resources efficiently and manage profit margins effectively.

- Productivity insights: Identifies unproductive habits or bottlenecks, enabling improved team efficiency.

Who Should Use It

- Service‑based professionals (consultants, design agencies, legal firms, software dev shops) who bill by time and need to track both client‑work and internal work.

- Remote or hybrid teams needing accurate attendance, productivity and project tracking.

- Businesses wanting a single solution for time and project tracking, billing and reporting.

Conclusion

Understanding and managing billable vs non-billable hours is key to accurate invoicing, better resource allocation, and increased profitability.

Whether you run a small agency or a large firm, clear time tracking reduces revenue loss and increases efficiency.

By avoiding common tracking mistakes and using tools like Desklog, you can automate time tracking, clearly tag work as billable or non-billable, and generate accurate, professional invoices without the guesswork.

With features like real-time tracking, built-in invoicing, and intelligent reporting, Desklog helps you to take full control of your time and turn it into measurable growth.

FAQ

1 What counts as billable vs non-billable hours?

Billable hours are those directly related to tasks you can charge for, like consulting, design, or development.

Non-billable hours include internal activities such as admin work, meetings, training, or marketing.

2 Why is tracking non-billable time important?

Tracking non-billable time helps you understand where resources are spent outside of revenue-generating work.

This insight allows you to reduce inefficiencies, plan capacity, and improve your billable-to-non-billable ratio, leading to better profitability.

3 How do I calculate billable hours?

Track all work hours, filter out non-billable activities, and sum the time spent on client-related tasks.

Formula: Billable Hours = Total Client Work Time – Non-Billable Time

4 Can non-billable tasks become billable?

Yes, if clients agree, some typically non-billable tasks (like project planning, discovery calls, or onboarding) can be included in your scope of work.

Clarify this in your contract to avoid disputes and ensure accurate billing.

5 What are common mistakes in tracking billable hours?

Frequent errors include not defining billable work clearly, using vague time categories, forgetting to log small tasks (like emails), and relying solely on manual tracking.

These issues lead to under-billing and inaccurate invoicing.

6 How can software help track billable and non-billable time?

Time tracking software like Desklog automates logging, categorizes time entries by task or client, tags activities as billable or non-billable, and generates reports.

This minimizes human error and ensures every minute is properly accounted for.

7 Should freelancers and small teams track non-billable time too?

Absolutely. For freelancers and small teams, non-billable hours often eat into profits.

Tracking them reveals how much time is spent on admin, sales, or unpaid prep work—insights you can use to refine operations or adjust pricing.

8 What’s the best way to improve the billable to non-billable ratio?

Start by identifying non-billable time sinks, then automate repetitive tasks, set clear priorities, and schedule focused client work blocks.

Use tools that promote real-time tracking and provide visibility into how time is being spent.